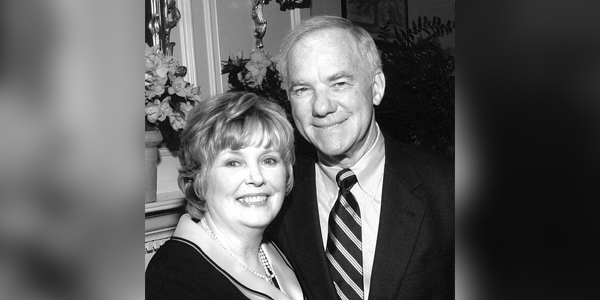

Hugh and Kay McDonald Gift Annuity - After a successful career and many years of community and civic service, Hugh G. McDonald, Jr. wanted to provide for his wife, Kay, and the University of Louisiana Monroe through his estate. With that mindset, he established gift annuities with the ULM Foundation which will provide the security of a fixed, reliable income for life.

Suzzon Jackson established and contributed to the Sherman/Jackson Endowed Scholarship while she was still living — she also encouraged family and friends to make annual contributions. She then named the ULM Foundation as a beneficiary of an annuity and included her bequest to the Foundation in her Living Trust. These actions have ensured that her scholarship will help deserving students pursue their dreams for years to come.

ULM alumni, Charles and Kay McDonald, gifted a $250,000 life insurance policy to the ULM Foundation designated to benefit several programs in perpetuity.

A ULM alumnus included the ULM Foundation in her will to establish a $1,000,000 endowed scholarship in Education.

Learn how others have made an impact through their acts of giving to our organization and others.